Billionaire pub baron Bruce Mathieson has called for a board shake-up of the country’s largest pubs and pokies owner Endeavour, calling out chair Peter Hearl and chief executive Steve Donohue for “disgraceful” decisions which he claims contributed to the loss of millions of dollars in market capitalisation.

Mathieson, who is the group’s largest shareholder and owns 15 per cent, has put his support behind retail veteran Bill Wavish who self-nominated for an independent director position but is not expected to be put forward. The market capitalisation of Endeavour – which demerged from Woolworths in 2021 – has shed about $5 million in the past 12 months.

Billionare Bruce Mathieson has said Bill Wavish should be elected to the board of Endeavour and said the existing board “boys club” has iced him out. Credit: Arsineh Houspian

“I don’t think anyone in this country would stand by the performance of this group under the leadership of Peter Hearl and Steve Donohue. It has been an absolute disaster and their decisions have been disgraceful,” Mathieson said on Tuesday.

“We are blessed to have a bloke like [Wavish] apply. What Endeavour owns is beyond belief, 350 pubs, big outlets, no other business has assets like it and yet it does not perform. All the pub owners I speak to are firing like you can’t believe and yet nothing for shareholders of their owners,” Mathieson said.

Mathieson called out Endeavour’s decision to implement Victoria’s looming gambling reforms 10 months early is costing millions in revenue. Endeavour announced in July it would adjust the hours of gaming machine areas at its ALH Hotels in Victoria, so they close between 4am and 10am by August 31.

“The hours they gave up in Victoria will cost millions and millions of dollars. It’s just wrong,” Mathieson said.

Endeavour is expected to release its annual general meeting notice on Wednesday morning where it will recommend two existing directors be put forward with support of the board to be voted on by shareholders. Those directors are Bruce Mathieson jr and Rod van Onselen.

Endeavour said a formal process to appoint two new non-executive directors for the group was under way.

“The board acknowledges Mr Wavish’s nomination, having commenced engagement with him and extended the invitation to participate in the current board recruitment process under way,” a spokesperson for the business said.

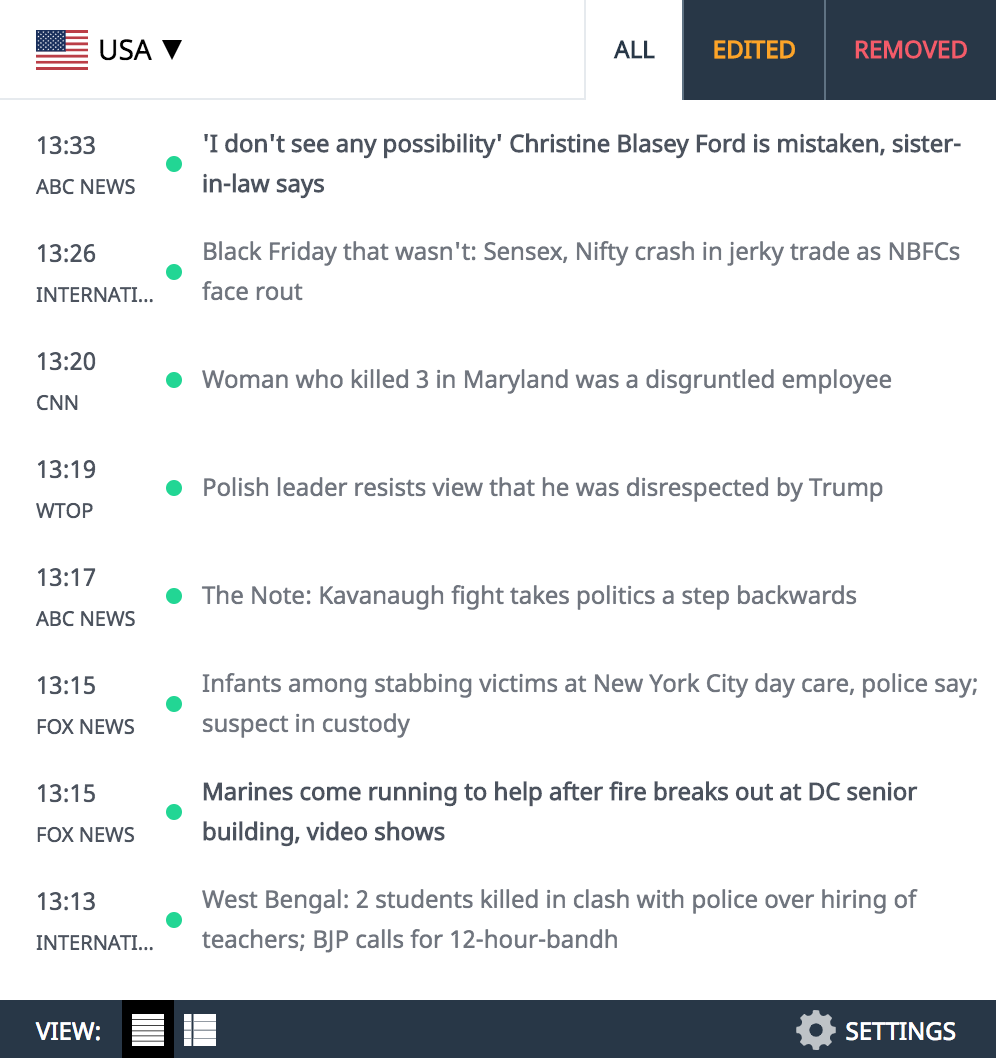

Loading

Wavish, who is the former chief financial officer of Woolworths and prior Myer chair, said the current directors did not have enough retail or pubs experience to adequately govern the business.

“They don’t have the range of skills on the board that I would like to see. I get the feeling the board aren’t consulted enough on things like strategy. I want to help get the strategies right,” he said.

“In my biased view I meet all of their requirements. I have liquor experience, retail experience, chief executive officer experience, chief financial officer experience, international experience and also liquor, gaming and hotel experience, so I was optimistic but less so now,” he said.

Directors must pass a series of probity and regulatory checks to be elected to the board of Endeavour. As it’s the largest pokies operator in the country, part of these checks require regulatory approvals from every state in which its pubs operate. This process can take between eight weeks and six months. Endeavour’s constitution says that to stand for election a candidate must have obtained all necessary regulatory approvals.

Mathieson’s son Bruce jr is expected to be put forward for re-election at this year’s annual general meeting.

Wavish acknowledged he lodged his nomination on the day Endeavour’s deadline closed, August 31, and is still in the process of attaining these approvals. But he said he did not understand why the board would not put him up for a shareholder vote subject to probity.

“After two consecutive years of underperformance, calling for more time is no longer

acceptable. As a starting point, an urgent and fulsome review of capex is required to ensure

the company is delivering a return on investment for shareholders.”

He also said Endeavour’s brand propositions had “lost focus” and “become diluted” with competitors gaining traction and its cost base continuing to bloat. The group’s costs increased by more than 11 per cent in 2023 and its inventory cover has “blown out” to 72 days.

Endeavour declared a full-year dividend of 21.8¢, a 7.9 per cent increase on the year prior after posting a $529 million profit which fell short of analyst expectations. Group sales rose 2.5 per cent to $11.9 billion, while earnings before interest and tax jumped by 10.7 per cent to $1 billion

Its share price has fallen by more than 20 per cent over the past year to $5.30 on Tuesday.

The Business Briefing newsletter delivers major stories, exclusive coverage and expert opinion. Sign up to get it every weekday morning.